The hype

During part of the past year I designed and implemented an enterprise blockchain platform for a financial company based in Estonia, releasing gold-backed cryptocurrency to aid trading with gold.

It’s a hot topic, right? Blockchain and cryptocurrencies are super fashionable right now, generating a lot of noise, and not just in the digital realm: the physical high street is getting in on the action, too. The fact that cryptocurrencies represent only barely-charted territory is of course, half the attraction; without the right compass however, even the most intrepid of pioneers risks getting lost pretty quickly.

First of all, don’t be dazzled or intimidated by the media hype: big buzz sells newspapers and garners clicks, but thinking in extremes is neither a useful nor a serious approach to a very new and fast-developing technology.

Yes, blockchain and cryptocurrency is a paradigm-shift but that’s all the more reason to keep a cool head and examine both the big picture and the detail.

History of Money

As the scope of trade widens, the importance of mutual anchor points and federal metrics increases. It’s the same for all abstract systems: language and culture also depend increasingly on standardisation and regulatory authority as they evolve. For more on this, it’s worth checking out this title by Harvard professor, Niall Ferguson:

The Ascent of Money: A Financial History of the World

As Ferguson illustrates with countless examples from past to present in this great book, the history of financial products repeatedly shows a need for stability and security growing alongside each new product as it becomes more mainstream. This need for stability and security is met by regulation and agreement. Yes, this can be taken too far, leading to an unholy union of bureaucracy and corruption, or state-backed monopoly masquerading as free-trade, or paradoxical risk-incentivisation, but with no systemic regulation or agreement at all there is no ‘common language’ and no guarantee on security, effectively limiting trade to local, hand-to-hand, highly inefficient operations.

Back to bitcoin, there is no denying the new wave of monetary liberalisation affecting all sectors where the clarity of data is indispensable. However, the inescapable truth is that bitcoin is missing legitimacy and regulation. Infiltrated by the criminal underworld and driven by hype and speculation, bitcoin’s recent ‘stellar’ growth masks its tiny relative footprint, the point being that major players will remain bearish until it becomes truly legitimate in terms of practicality and security.

Meanwhile, just as disorganised popular uprisings may be sold as sacred revolutions, so bitcoin, to an extent, benefits from its partisan image compared to that of a docile follower-sheep. So, we have a situation where both the regulatory deficit and popular caricature might seem to spell disaster in a way.

Rest assured: the revolution is real, and while the flames are higher than anyone had anticipated, it was the technology under the hood - the blockchain - which caught fire and not the bitcoin in the trunk. To understand this, we have to move from the big picture to the technical details:

Terms

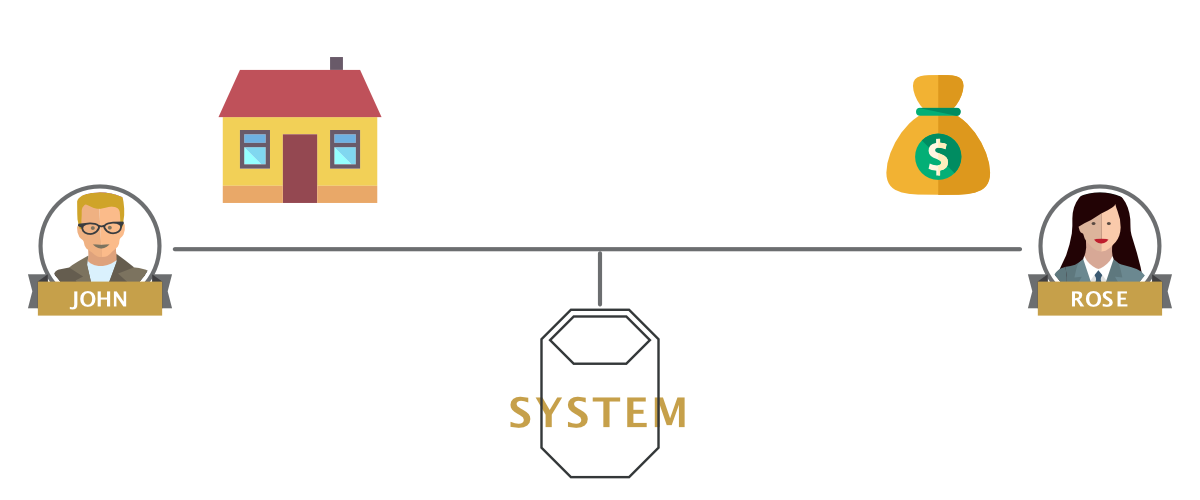

Let’s consider the services of an eBay-clone tailored to real estate. We’re buying and selling houses and apartments: Simple example.

The object of the trade, a property in our case, is given the name, asset. In a blockchain system, an asset can be anything: property, money, data, medical records, documents, etc. If you choose to create digital money as an asset, you are dealing with cryptocurrencies as a medium of exchange.

The flow or process during which assets are operated on, is called transaction. Transaction can be selling, delegation, or anything in relation to the transfer or other kind of management of an asset.

A subject of a transaction is called an entity. We perform transaction operations on assets in association with entities. Simple so far?

To ensure the authenticity and creditability of the transactions, the book of the records, called the ledger must be intact and clean.

This is what blockchain is intended to provide: an immutable ledger. The implication is seemingly limitless - invoking the sense of awe now automatically associated with blockchain and cryptocurrency.

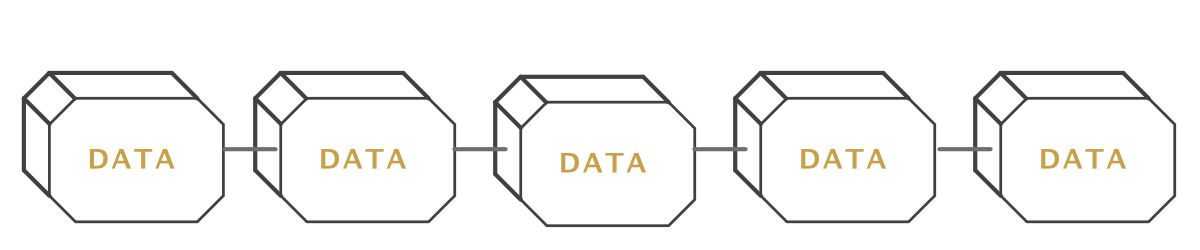

The ledger is represented as a continuously growing list of data units, called blocks, which are linked and secured using cryptography. Cryptography is present at many levels in these systems, at transaction-level, blockchain-level, contract-level… etc.

(Technical note: yes, blockchain is a one-dimensional list of data blocks in which information is held. One-dimensional linked lists were invented in IT some 40 years ago; the paradigm-shift can be found on the data-management level and not storage-level. Most blockchain platforms use ordinary and casual DB solution, of course.)

IT was missing a very important prohibition to ensure true cleanliness of data management at technological level: backward editing. This is as challenging to explore as space, but if the intactness of data can be guaranteed at technological level, beyond the reach of business cases, then the legal-conformity and incorruptibility can be easily defined and proven by design.

Data remains intact constantly in time. (It is vital that the level of the ledger/storage and the level of semantics formulated on the business level are not mixed. Storage level is not aware of the contextual meaning of the stored attributes…)

We also need to understand the term smart contract. You can simply see this as a validated and safe automated workflow:

For example, a smart contract called “sell” could perform the following:

- Money is withdrawn from the buyer’s account

- Transfer fee is computed and transferred to the platform’s account

- Remaining sum is transferred to the owner’s account

- House as Asset is consigned to the new owner

- Contract is generated and sent to both parties

Smart contract is a “code” executing a workflow in an automated way. Concept, implementation and capabilities might vary among blockchain platforms; the term itself is a very vague definition and is the least explored so far. Ideally, smart contracts represent a clear and intact meaning of the logic to be performed on the service level. A business case might involve multiple parties forming a network to interexchange assets. Public and private (or permissioned or privileged) networks can be differentiated by the process regulating how parties can join the network.

The network

In a public network like bitcoin, parties are allowed to join at will from anywhere, anytime.

Banks, medical facilities, and other such institutions favour private networks, which force parties to possess proper permission in order that they may join and access the network. Services involving medical files, for example, must comply with a bewildering number of legal regulations that ringfence a well-protected inner-circle of cooperating institutions.

These are two very distinct worlds: the gulf between them is clear. Is it too much to characterise them as ‘wild west’ and ‘clean street? One can find good reasons why banks, insurance companies and health institutions do not consider the cryptocurrencies worthy even of mention. The same ‘pioneer narrative’ that attracts desperadoes and prospectors calls to mind a swampy wilderness of dirt tracks and bandits for everybody else.

This is why we see the larger market figures flee from the bad associations and worse that bitcoin and co. might bring down upon them. Of course, institutions can create their own cryptocurrencies to act as a medium for transactions but only for internal use.

In any kind of network, the most fundamental questions are

- How can entities trust each? What if a party is appending a new block to the ledger?

- Should all parties accept the new data without any concern?

Legitimacy requires that a guarantee at technological level must be constantly present for all transactions a party might initiate. In a public cryptocurrency network, a mathematical computation is performed by many-many parties of the network aimed to repel all attempts of malicious operation. That computation Is called mining:

The infamous process which is responsible for an aggressive electricity consumption exceeding the needs of a small country and draining computer power from other applications. Furthermore, the mining process and its applications are hitting the system so hard, the typical transfer rate of bitcoin hovers around a measly two per second.

Can you imagine a credible global banking system with a throughput of only two transactions in a second?! This presents the other big challenge – scalability, and this is where a private network has its other obvious advantage. In a private network, a custom-made “light” consensus-algorithm can easily provide the required trust among certified parties while keeping the necessary transaction rate sufficiently high so as to support a realistic business environment. This is a space where parties are permissioned and limited in number. They operate expediently over the same stack and share and sign all smart contracts appearing in the workflows modelled, in other words: not the wild west.

Don’t get me wrong: I’m not just dismissing public network or bitcoin and co. as unimportant or writing it off as a wicked hoax – far from it. As somebody who has just designed and implemented an enterprise blockchain application, I’m sold on the liberalisation they represent and the message they convey: time to change. And we should measure that message with adequate gravity. We need to set fire to the old IT in order to build more trustworthy systems; we have to set fire to the old autocratic financial system in order to become more transparent and accountable.

Without any further moralising, suffice it to say that I believe in enterprise blockchain and I believe it can be a force for good. These platforms aim to provide blockchain-based services and toolset tuned to the need of enterprises, organisations and partners. You can build an incorruptible solution to:

- coordinate clinical trials with automated contract signing, payment as features.

- handle accounts of pensions to keep them safe and untouchable

- store R&D results to guarantee its cleanness and immutability

Immutability is the biggest killer feature of blockchain: Arguably, it is the long-awaited philosophical and ethical approach for data handling in IT and business processes. You can google for enterprise blockchain platforms easily: IBM Hyperledger, Core Chain, and Corda are great solutions for implementing such systems for various business cases.

Unfortunately, the concept of smart contracts embraced by those platforms has proven highly inadequate. My business case, with its extravagant quantities of digital signatures, drove me in frustration down a rogue road: the implementation a unique enterprise platform. Following a long design period and even longer implementation period, a new platform was born supporting a wide range of business services and supporting the automation of:

- Proof of ownership

- Counter-signing

- Witnessing

- Transition of rights

- Procuration

- etc…

In my next blog, I would like to introduce the process (and hopefully, some of the fun!) of the creation of such a platform and demonstrate something of the potential for growth in this field. Code dwellers, stay tuned...!

Feel free to share your thoughts in comments below, I am willing to exchange thoughts with you.

If you consider to start a new project soon or to move your stack to NodeJS and do not mind some support and consulting, please let us know.

We are open for business at NLV8 Technologies.